PwC has released their special report on the annual Global Entertainment & Media Outlook. Now in its 22nd year, the Outlook is the premier source of information and insight into the evolution of this dynamic, diverse and fast-changing sector.

In 2020, the pandemic triggered the sharpest contraction in overall E&M revenues in the history of this research. And it accelerated changes in consumer behaviour to pull forward digital disruption and industry tipping points by several years. In 2021, those tipping points morphed and coalesced into power shifts that are rapidly reshaping the industry.

One of the clearest trends is that players are realising they may be better served by figuring out how to meet consumers at their convenience. People prefer the ease and convenience of self-directed podcast listening to adhering to radio stations’ schedules. As a result, audio content providers are diversifying their offerings to become more of a destination where consumers will linger and browse. For example, although podcast platforms in many territories tend to specialise in particular topics—comedy, politics and so on—the leading providers in the mature Chinese market, such as Ximalaya and Nasdaq-listed Lizhi, aggregate many different subjects and types of podcasts into a single offering. Clubhouse and Spotify use live and recorded podcasts to re-create a personalised radio type experience.

Total global entertainment and media (E&M) revenue fell -3.8% year on year in 2020, by far the most significant drop in revenue — US$81.0bn, or more than the value of 2020’s entire music, radio and podcasts segment — in the history of the Global Entertainment and Media Outlook.

As more global regions emerge from lockdown and see increasing rates of vaccination, a forecast year-on-year rise of 6.5% in 2021 and a further 6.7% rise in 2022 will help drive total global E&M revenue to increase at a 5.0% five-year CAGR. However, this seemingly healthy growth comes from a greatly depressed base year — extending the CAGR period to six years provides a less optimistic picture with a rate of just 3.5%.

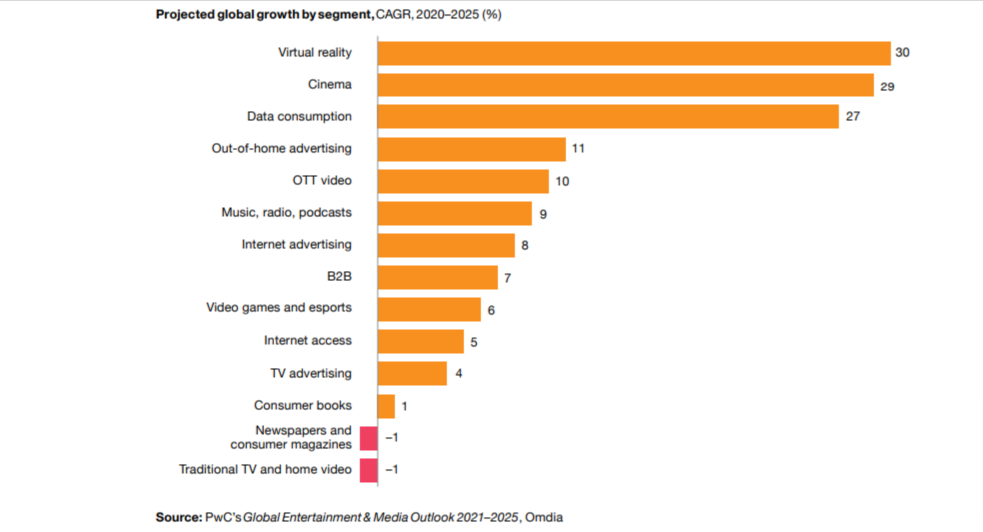

Sectors that meet digital and mobile consumers where they are find rapid growth. The projected CAGR for Virtual Reality from 2020-25 is the highest among all segments at 30 percent, while Music, Radio and Podcasts are projected to grow at 9 percent.